View:

May 02, 2024

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

May 01, 2024

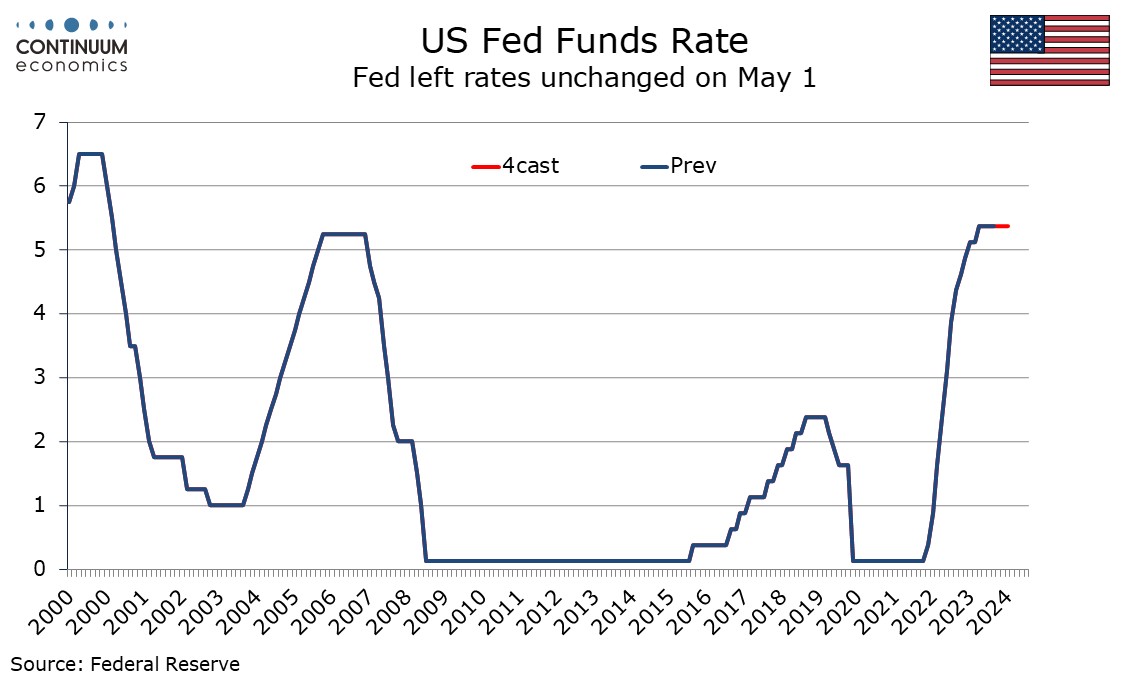

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

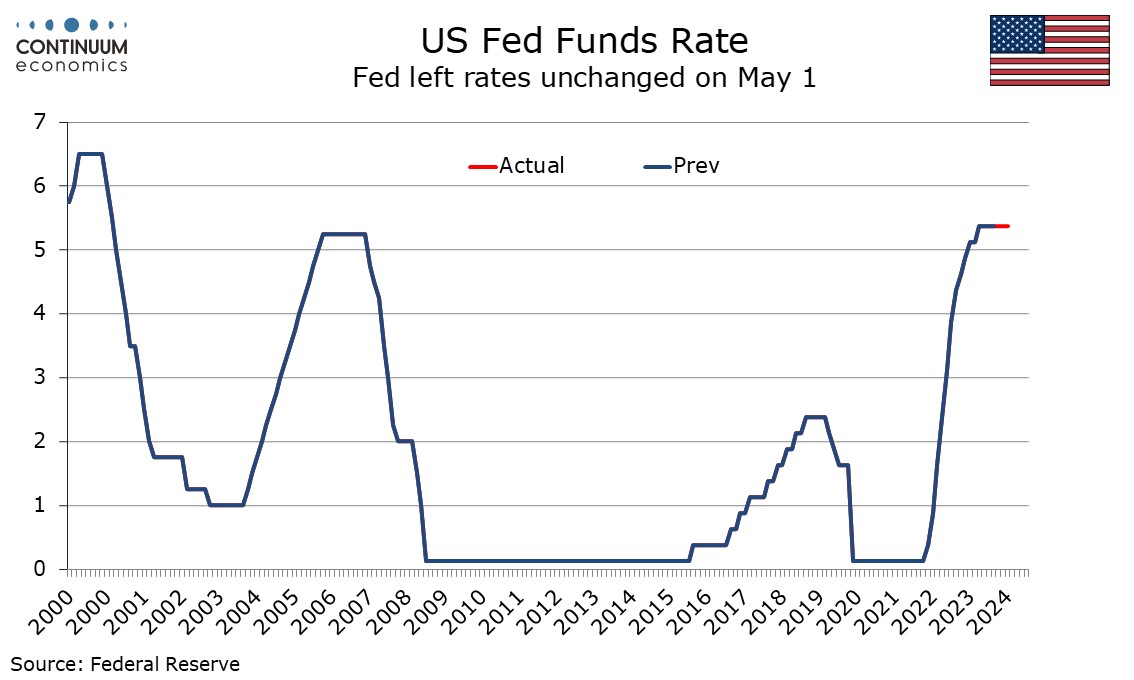

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu

U.S. March JOLTS report weaker, as is April ISM Manufacturing, but Prices Paid rise

May 1, 2024 2:30 PM UTC

March’s JOLTS report has seen a sharp decline in job openings, to 8488k from 8813k (the latter a modest upward revision from 8756k). This with a slightly slower ISM manufacturing index if 49.2 from 50.3, hints at slowing activity in early Q2, though ISM prices paid at 60.9 from 55.8 are worryingly

Preview: Due May 2 - U.S. March Trade Balance - Deficit to increase on weaker goods exports

May 1, 2024 12:59 PM UTC

We expect March’s trade deficit to see a marginal increase to $69.2bn from $68.9bn, with a 2.0% decline in exports and a 1.5% decline in imports. This would be the fourth straight increase in the deficit to its highest level since April 2023.

U.S. April ADP Employment - Trend looking stronger, payroll implications unclear

May 1, 2024 12:39 PM UTC

ADP’s April estimate for private sector employment growth of 192k is on the high side of expectations though not quite as strong as the revised March gain of 208k (revised from 184k). ADP trend has picked up in the last three months but this may be catch up with strength in non-farm payrolls.

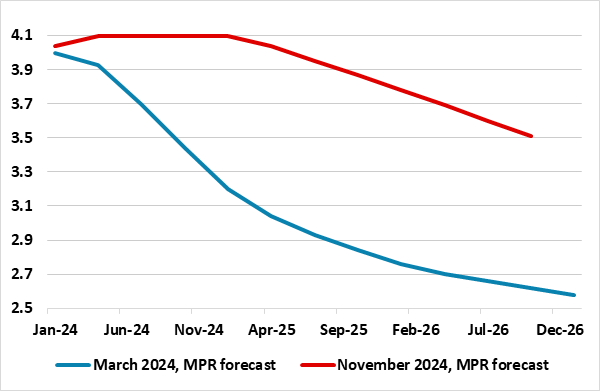

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

Asia Open - Overnight Highlights

May 1, 2024 12:34 AM UTC

EMERGING ASIA

EM currencies perform mostly weaker against the USD as the greenback strengthens on fear of Fed tilting hawkish after strong than expected U.S. wage data and haven bids from falling equity. SGD saw the largest losses of 0.42%, followed by KRW 0.35%, CNY 0.17%, PHP and CNH 0.15%, MYR 0.1

April 30, 2024

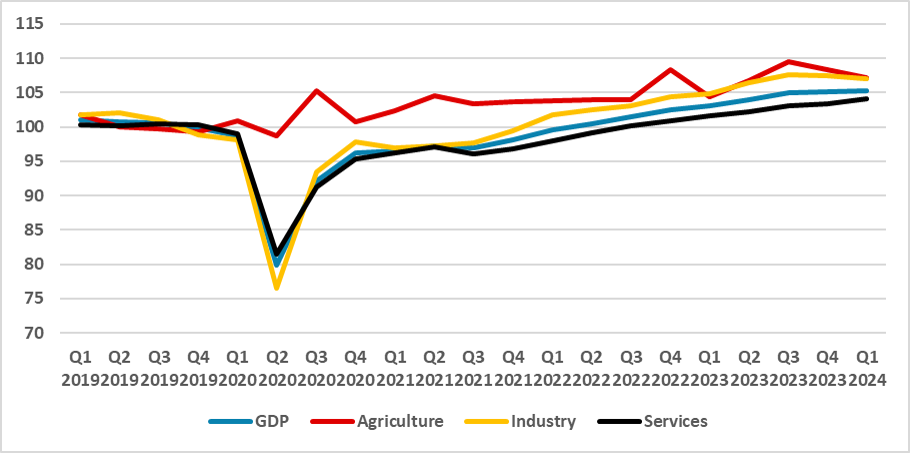

Mexico GDP Review: 0.2% Growth but Still Subpar

April 30, 2024 5:54 PM UTC

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Service