View:

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

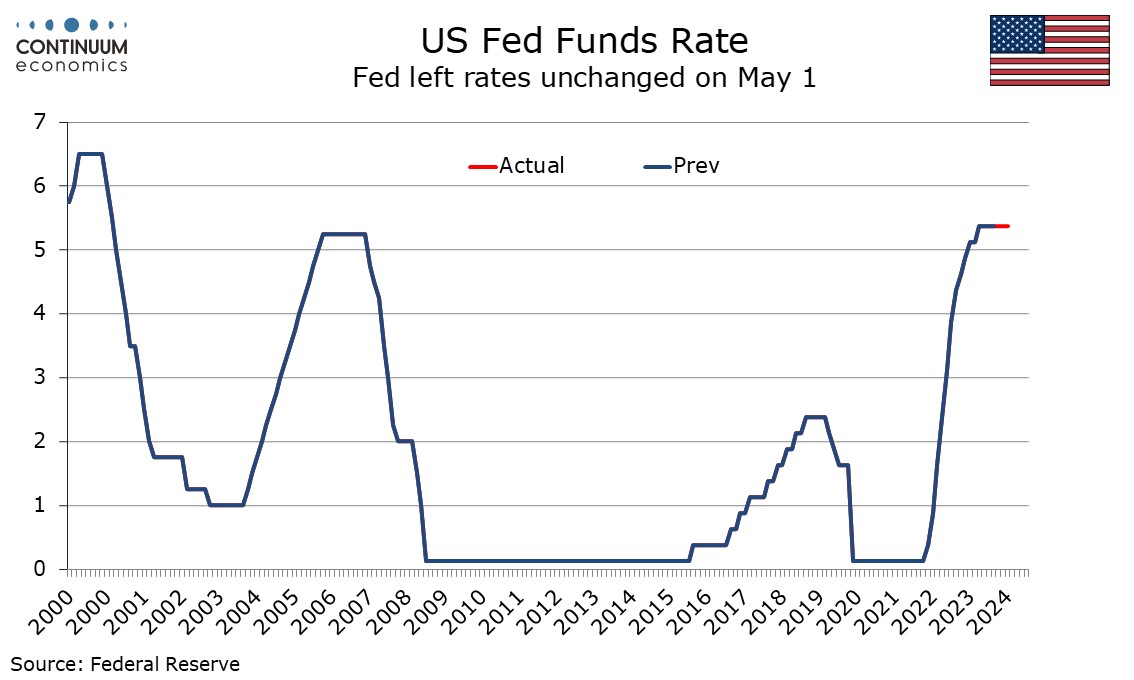

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

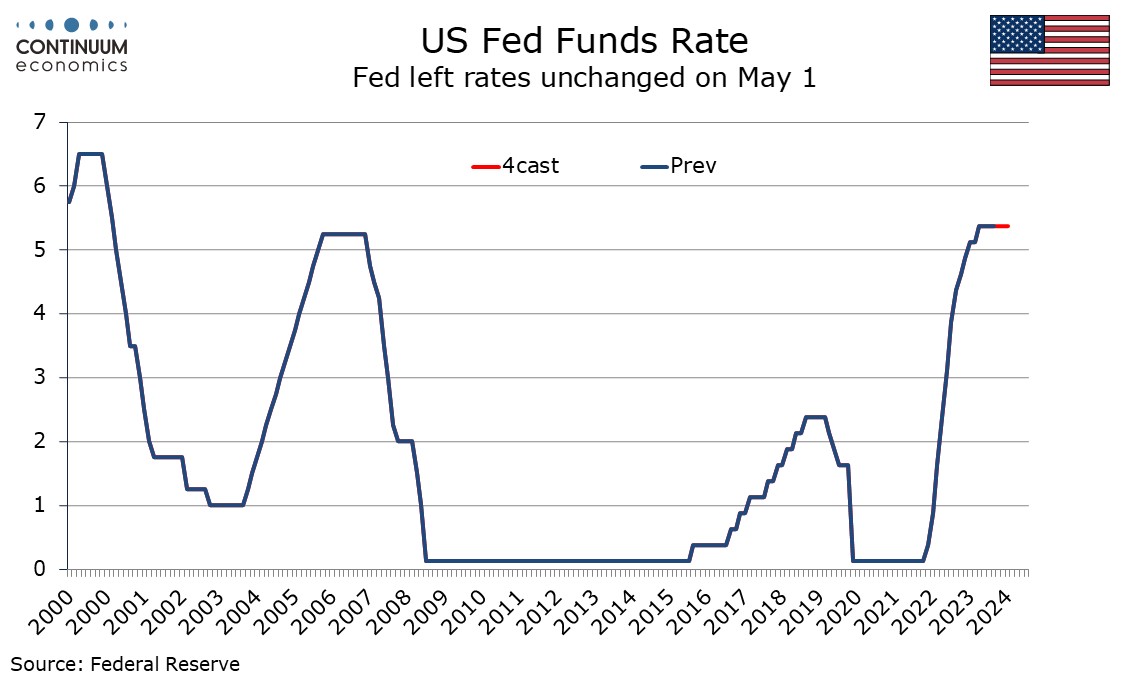

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

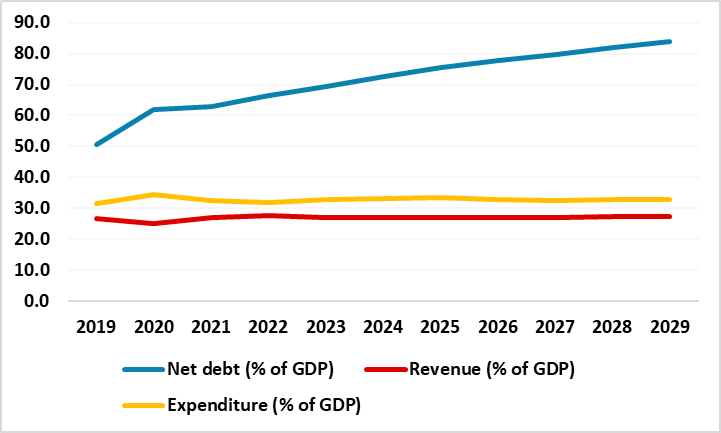

South Africa’s Fiscal Outlook Under Spotlights as the Elections Are Approaching

May 1, 2024 6:45 PM UTC

Bottom line: South Africa policy makers remain concerned about government debt trajectory, large domestic and international financing needs and elevated country risk premium before fast-approaching elections on May 29. We think South Africa’s general government fiscal balance and debt trajectory w

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu

U.S. March JOLTS report weaker, as is April ISM Manufacturing, but Prices Paid rise

May 1, 2024 2:30 PM UTC

March’s JOLTS report has seen a sharp decline in job openings, to 8488k from 8813k (the latter a modest upward revision from 8756k). This with a slightly slower ISM manufacturing index if 49.2 from 50.3, hints at slowing activity in early Q2, though ISM prices paid at 60.9 from 55.8 are worryingly

Preview: Due May 2 - U.S. March Trade Balance - Deficit to increase on weaker goods exports

May 1, 2024 12:59 PM UTC

We expect March’s trade deficit to see a marginal increase to $69.2bn from $68.9bn, with a 2.0% decline in exports and a 1.5% decline in imports. This would be the fourth straight increase in the deficit to its highest level since April 2023.

U.S. April ADP Employment - Trend looking stronger, payroll implications unclear

May 1, 2024 12:39 PM UTC

ADP’s April estimate for private sector employment growth of 192k is on the high side of expectations though not quite as strong as the revised March gain of 208k (revised from 184k). ADP trend has picked up in the last three months but this may be catch up with strength in non-farm payrolls.