View:

May 02, 2024

May 01, 2024

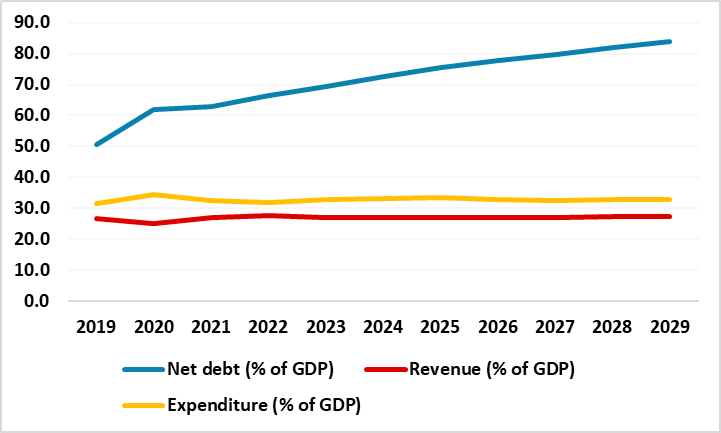

South Africa’s Fiscal Outlook Under Spotlights as the Elections Are Approaching

May 1, 2024 6:45 PM UTC

Bottom line: South Africa policy makers remain concerned about government debt trajectory, large domestic and international financing needs and elevated country risk premium before fast-approaching elections on May 29. We think South Africa’s general government fiscal balance and debt trajectory w

U.S. March JOLTS report weaker, as is April ISM Manufacturing, but Prices Paid rise

May 1, 2024 2:30 PM UTC

March’s JOLTS report has seen a sharp decline in job openings, to 8488k from 8813k (the latter a modest upward revision from 8756k). This with a slightly slower ISM manufacturing index if 49.2 from 50.3, hints at slowing activity in early Q2, though ISM prices paid at 60.9 from 55.8 are worryingly

Preview: Due May 2 - U.S. March Trade Balance - Deficit to increase on weaker goods exports

May 1, 2024 12:59 PM UTC

We expect March’s trade deficit to see a marginal increase to $69.2bn from $68.9bn, with a 2.0% decline in exports and a 1.5% decline in imports. This would be the fourth straight increase in the deficit to its highest level since April 2023.

U.S. April ADP Employment - Trend looking stronger, payroll implications unclear

May 1, 2024 12:39 PM UTC

ADP’s April estimate for private sector employment growth of 192k is on the high side of expectations though not quite as strong as the revised March gain of 208k (revised from 184k). ADP trend has picked up in the last three months but this may be catch up with strength in non-farm payrolls.

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

April 30, 2024

Preview: Due May 15 - U.S. April CPI - Core rate not quite as strong as the preceding three months

April 30, 2024 5:15 PM UTC

We expect April CPI to rise by 0.4% overall for a third straight month but with the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though inflationary pressures will still look quite significant in A

U.S. April Consumer Confidence - Labor markets seen as less strong

April 30, 2024 2:23 PM UTC

April consumer confidence with a fall to 97.0 from 103.1 is weaker than expected and the lowest since July 2022. The easiest explanation for this is rising bond yields and fading expectations for rate cuts, though there are hints that the labor market is losing momentum too.

Canada February GDP - Q1 looking less positive than previously projected

April 30, 2024 1:20 PM UTC

February Canadian GDP saw a second straight rise, but at 0.2% was below the 0.4% projected with January’s data and January was revised down to a 0.5% increase from 0.6%. The advance estimate for March is unchanged, which would leave a 0.6% rise (2.5% annualized) in Q1.

U.S. Q1 Employment Cost Index - Acceleration will add to Fed concerns on inflation

April 30, 2024 12:46 PM UTC

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023.

Preview: Due May 1 - U.S. April ADP Employment - Underperforming payrolls

April 30, 2024 12:10 PM UTC

We expect a 150k increase in April’s ADP estimate for private sector employment growth, which would be in line with recent trend, but continuing to underperform private sector non-farm payrolls, which we expect to rise by 195k. We expect overall payrolls to rise by 255k.